Long term volatility 'turn ratio' has flagged a bottom in volatility & ES futures levels are likely flashing a 'heads up' moment. The previous 'turn ratio' that flagged a bottom at this degree was a few weeks prior to the 2020 top in the market- this is not a signal that shows up with any frequency. The date of the current signal is Fri. 7/9/21. A daily turn ratio and associated parameter criteria needs to trip next. The potential for some dramatic price corrective moves exists inside the set up that is printing to date.

Additionally- on trading week ending Fri. 3/20/20 volatility turn ration flagged a top. Typically the volatility acceleration on a strong down move lags the actual bottom in volatility derivatives due to the speed of daily moves.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Saturday, July 31, 2021

Weekly Turn Ratio Flagged / ES In LT Target Zone #1 [4417 +/-]

Friday, July 30, 2021

Volatility Derivative Oversold Condition At ES 4417 Zone

EOD: Not much to report except the weekly breadth closed at a very slight negative print on the red signal line. All parameters in MACD printed negative values.. No signals of any importance apart from that. A lot further breadth decline needed before a terminal top can be anticipated. Could keep everyone guessing which is why it's important to wait for definitive turn signals. Most action behind the scenes was back and forth in volatility derivatives. VXX was oversold yesterday and corrected today. Back the other way on Monday?

Original post:

Looking at the breadth moves for yesterday- VXX oversold 61% at -2.8% [vxx decline / histo rise] [typical is -1.7% +/-] so this was excessive beyond 'normal'. Chart shows NYAD daily MACD HISTOGRAM at bottom with VXX decline vs. breadth acceleration up at critical junctures. Pairing this set up with the ES 4417 proposed key level projection looks to support the importance of this price zone in the market. Some action was expected soon per the previous posts. Still no terminal top but could get interesting moving forward. Overnight movement in ES looks like a reaction to this condition. If a pullback continues through Friday's close and it also adds to the weekly breadth declining numbers- that will be an important parameter in the overall market breadth pattern regarding a pending top at a medium/large degree.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Wednesday, July 28, 2021

ES 4417 Zone Projected From March '21 Now Touched

EOD: ES poked above and closed below 4417 zone and VXX hit a few cents below 29.32 target zone but closed above that price. Overall, the volatility 'derivatives stress' ratio showed a reading supporting the market move up so more could be on tap tomorrow or a small pullback could ensue.

10:52am EST: VXX 29.35 price zone is hitting where 29.32 +/- was a fib ext. tgt. so we will have to see if that has any significance going into the close today. While not being the typical extension price of 28.09 shown, it could produce a minor resistance bounce while on it's way to the lower target zone.

ES 4417 zone was preliminary projected during March 2021 and here we are. At best it is most likely a first target of at least two long-term projections. Currently the vectors are aligning with target zones projected from 3/23/20 so some action is expected going forward.

Comment: Headlines and Fed speak etc. will mislead many looking at the market. The only thing that matters regarding direction is what the market tells us it is doing at specific degrees & time frames often requiring historically demonstrable evidence of the kind attempted here in studies and analyses. That's all we got...

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Tuesday, July 27, 2021

Daily Breadth Has Hit Same Resistance on 10/11/19, 1/20/21 & 7/12/21

EOD: ES 4417 pretty much hit and rejected so far. Could be setting up a minor top to arrive this week. There are gaps down to be filled in some instruments and vector analysis shows this decline today was a reaction to a one-day divergence between VIX [up] and the volatility derivative VXX [down] that set up yesterday- Mon. 7/26/21. If that is indeed the case for the decline today, then a few more sessions will clear it up. Signs are pointing to a possible pivot top to arrive soon.

Original post:

Could be a double top locally [2021] on the daily breadth 200ma. Triple top multi-yearly?. Still waiting for a pivot top to print on ES [4417 + zone]. Could be close. Terminal top to come later.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Monday, July 26, 2021

ES 4417 Zone Is A Long-Term Target

ES 4417 zone [+ higher] could be significant. See post referencing the chart from March 2021. Length of wave 'E-v' = length 'C-iii' on that chart at 4417 so this would likely be a nominal target zone

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Saturday, July 24, 2021

Wave [v] Zone Likely Showed Up + This Study May Be Flashing A Set Up

See original post below. This one appeared significant enough to place at the top...maybe it's way off but it matches so many other 'studies' of this type that have been posted over the last year or so. It's a big pattern just like the others and takes time to complete. Expanding megaphones are corrective by nature but the 'corrective' aspect potential currently could be significant. If the weekly 200ma breaks below the 4-point center line, could be some real concerns. Particularly consider how this aligns with a similar look at the ARMS INDEX recently.

Original post:

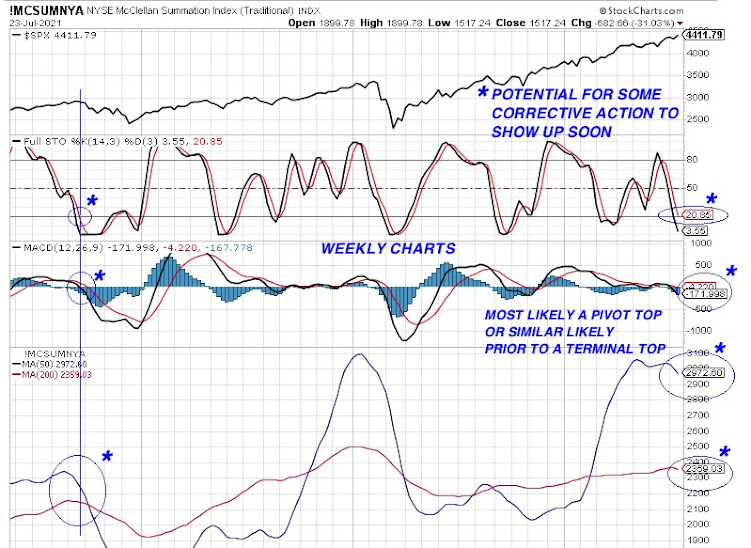

Week ending frequently prints a top zone on legs up so next week may bring more indication. The weekly summation index is nothing if but persistent in rolling over. Breadth continues on a downward trajectory but the red [26] signal on the NYAD MACD is at +10 - it's lowest since 3/1/21 and it is a steep fall so far. However, not until it prints negative values can a terminal top be seriously considered.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Friday, July 23, 2021

New Leg Up From 7/19/21 Targets

Note: numbered wave progression count is revised. [not necessarily EW rules]

Commentary: there were sudden drops in VIX volatility [VVIX] on 7/21 and 7/22 both on the opening hourly candles.

On 7/21 VVIX dropped 7.5% and on 7/22 it dropped 21%- each recovered quickly. These can be classified as volatility 'crushes'. It was extremely unusual in VVIX so not sure what that signifies as far as moving forward. Whenever these types of behaviors have exhibited in the past particularly in VIX, some kind of short-term down/up [to new highs] action in the market often follows. There is the potential for these lows to become targets at some point on an intraday/daily basis quite likely tied to these new market highs. No top yet but stay focused- breadth may continue it's slide and diverge from new highs.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Thursday, July 22, 2021

Wave [iii] Up About To Hit

EOD: The drop that was expected has created a retrace back up. However, there are possibilities that the drop was insufficient so a closer look is required. A detailed investigation of supporting signals is under review. Please check back.

Morning headlines .. "Stocks Shrug Off Virus Worries" . . another poll from a trillion traders surveyed [not likely]. Just make something up. Sure that's the ticket or perhaps do some real analysis and publish that.

It is the market that LEADS the economy and events- not the other way around. It is always a bull market with corrections along the way. Period. Disease in the populace has never stopped the market from progressing even if a huge correction arrives.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Tuesday, July 20, 2021

Breadth Overbought Again - Higher Targets Beckon

Breadth explosions in both directions do not speak to stability so could be more zig-zagging to keep everybody guessing but ultimately, new highs are required.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Sunday, July 18, 2021

Deep Retrace / New Leg Up

Update: 11:07am EST: ES 4232.50 +/- is a measured extension wave [iii] down. Looks likely bouncing at ES 4231.25 - close enough to complete a wave [iii] down. Let's see how it closes the day.

Open update: the whole leg from 7/8/2020 in ES has been taken out. A slightly lower extension target will most likely form a bounce support zone. Daily breadth is way over-sold. Check back later for an extension calculation analysis. Thursday's expected pattern [7/15/20] looks likely to be playing out..[from the red dot].. The 'mkt top' comment is only a low degree top but likely will include some drama. For example- the low from 5/12/2021 will likely be targeted on the next top signal. [VXX below takes out 48.00]

Original post-

The market blog world is getting excited over the last pull back... and here we go again reading tea leaves right on cue.. pick any one from a few- "Delta variant..blah..blah" [of course it's the pandemic rising once again]. Sorry, it gets so old seeing knee-jerk reactions that are absolutely meaningless in terms of sensible analysis and trading prognoses. The pandemic was with us from 3/23/2020 and look at the market rise from there. That is conveniently dismissed or somehow 'reasoned away' with another one from the list- a constant reminder of how difficult proper market analysis can be without a data-based grounding that repeatedly works over time

Upper chart [first one below] describes a modest retrace that was proposed could occur prior to a new up leg taking off. ES 4391.50 zone was shown as a target area in a prior post and a pull back occurred just a few cents from that number.

A new leg up [when it occurs] will likely target the 'old' extensions already in place. [ES 4417 already identified + new highs likely short-term]. This phenomena has occurred frequently as readers will have noted. Not until weekly breadth [NYAD MACD] prints negative signal values [9-period ema] at the end of completed weeks [Fri. - Tues. nominally] can a meaningful correction commence.

If we have missed a signal in the near-term pattern sequence, that will become apparent fairly soon and we will complete a new analysis. It is not expected to vary greatly at the higher degree expectation however.

Lower chart [at very bottom] is a longer-term analysis based on a very detailed look at the progression of volatility vectors from 1995 to today. The development criteria is not shown as it is quite involved and is somewhat experimental but is based on historical observations. We thought to roll it out anyway at least as a possibility. Perhaps we are being reckless again. We shall see eventually. Yes- those are nominally 1,500 - 2,000 point moves overall in the SP-500 - a maximum -45% +/- corrective. Note: we just had an approximate -34% corrective move down to 3/23/2020 and this market is likely just getting started.

It was noted in prior posts that the breadth pattern [NYAD MACD] was 'floating' with little in the way of a stable transition print and the result would be short-term instability that would scare more than a few: 7/9/2021 post. Looks like that may be about to play out.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Thursday, July 15, 2021

Summation Index Update Indicates No Major Top Yet

2:48pm EST: ES 4340 zone is wave D-iv low area so could still be printing a wave D-iv down. E-v up likely still to come either from D-iv low or a new leg up after a deeper low.

Referring back to the summation index, a reasonable example of top building where the daily stochastic was bottomed [which often indicates a pending market bottom proximity] shows that 2018 created two 'tops'. See left-hand half of chart where entirely different summation patterns show at 'A' and 'B'. 'A' where the daily and weekly summation index stochastic was high and 'B' where the daily [and eventually, weekly] stochastic bottomed coincidentally with a market that had built a top.

Today's set up [right-hand half of chart] is similar but not exactly equivalent to the 2018 pattern at 'B' where daily stochastic has bottomed and weekly stoch. is descending which may also bottom, printing a top [pivot or pre-top at some degree] perhaps in another week or two?. It will likely not be much more than a pre-top given the positive nature of the weekly breadth NYAD MACD red signal level unless that changes dramatically to the downside.

If the pattern morphs into another form, a new analysis will be posted at that time. The main take-away was to establish that it was possible to build a top at some degree even with summation stochastic levels at zero however unusual that might be.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Tuesday, July 13, 2021

ES 4400+ Was Always The Target Zone

Lower Chart is reprint of chart posted on 3/12/21 [note- ES 4417 fib. ext. on both charts]. Likely ES 4417 is the pivot high target zone. Final high will be above that in that case.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Friday, July 9, 2021

Explosive Breadth Moves Are Likely Telegraphing An Unstable Situation

See morning chart for 7/13/21

Upper Chart: The evidence supporting the unusual nature of this market keeps adding up... still no top but better buckle up!

Top left inset is the NYAD weekly MACD [lower half] with the SP-500 [upper half]. The MACD plot is looking like huge 'square' waves which indicates sudden, extreme directional changes with little to no transition periods. This is erratic behavior extending over several weeks and looks like it's threatening to create even more volatility going forward. A pattern in weekly breadth this volatile hasn't been seen since 2007 top and it created a large and extended pivot prior to the decline proper.

The potential for the market to take-off to the upside in sustained weekly/monthly moves similar to previous periods this year seems much less a possibility because several primary vectors we watch have hit and penetrated target zones projected from the lows around 3/23/20 so the analysis based on that evidence is that we are seeing instability and not a fresh attack up. There are new highs yet to come but they may be short-lived. The red signal line on the NYAD MACD is still in positive territory but declining. When [and if] it goes below zero on the weekly print. that is our next heads-up moment.

Lower Chart: ARMS Index speculative study: Since 1990 evidence is that major tops have occurred when weekly 200ma is below 1.161. Current level is 1.084 therefore a major top at this level cannot be ruled out and is a higher than average possibility going forward when added to all the other evidence that has been presented recently. The idea of a head-and-shoulders forming [currently- right-shoulder] is tempting.

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Thursday, July 8, 2021

Volatile Moves Were Always Coming As These Alignments Demonstrate

7/9/2021 5am EST: Some short-term declining breadth relief was expected today. Let's see how it closes week ending.

Corrective pullbacks. Who knew?

Simple Answer Weekly Breadth [NYAD] MACD:

Expected next upper target zone- ES 4391.50 [current price @3:25pm- ES 4306]

Note: the 'typical' scale of price moves is most likely about to get larger in both directions. Breadth looks oversold so may improve tomorrow [less negative]

See Critical Long-Term UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Volatility Derivatives Setting Up

Original post:

VXX bounced from the intermediate target zone of 28.08 [28.07 actual low]. This action is likely preliminary to the pivot high about to arrive when VXX takes out it's recent lows. Could be more than a few whipsaws in this market first.

See Critical Long-Term

UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Wednesday, July 7, 2021

Topping Fractal From 2000 Using Weekly Vix

Overnight 7/8/2021: High so far is ES 4352.25. ES 4353.25 was a target from 6/1/2021 for a wave 'v' high so let's see if that begins a pivot process. [right hand side square box on chart below]

Intra-day update: watching now for this to develop:

Original post:

As readers of this blog will be aware, VectorSpike is not shy when it comes to plugging in evidence-based scenarios. Going with the VIX weekly chart pattern from 2000, an estimated similar stream of VIX aligned waves may have brought us to the current 'e' location. [yellow square border, next chart, bottom right]. This is of course a very highly speculative projection and the unfolding pattern going forward could potentially vary or be much more complex given the advanced nature of the market since the wave 1 up in the DOW Industrials from 1929. The Dow has now penetrated the significant 86 yr cycle period as can be seen from the confirmed alignment dates at the bottom of next chart. SVXY is shown on the inset at the bottom as some time alignments are very significant with regard to volatility derivative price moves as well as to the market price moves. Note the first dramatic drop in SVXY occurred almost exactly on 1929.75 + 86 yrs = 2015.75!. Subsequent moves have aligned with *2.15 yr increments since then. Pure chance? Seems unlikely with this much evidence now in the rear view mirror. *[(86 /10) / 4 = 2.15]

See Critical Long-Term

UPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Friday, July 2, 2021

Extension Target Zone Penetrated + 3rd Weekly Negative Breadth Bar Print

This pattern of three consecutive deep weekly histo bars on the NYAD MACD together with new highs and an arrival at a target zone is likely to create a situation quite soon as these divergences tend to resolve with an implied decline or pivot [decline/new high- fourth down bar]. Since the $VIX has printed new lows, some additional time may be required until we see it elevate as the market hits greater highs. Still no top but may get hairy. ES 4349.25 is the actual [local leg] target zone [classic extension w5 = Lw1 x 2.2381]

ES 4374 is the next 'long' target zone up from wave '4' low [w5 = Lw1 x 2.618].

Alternate count for the lower degree waves inside higher degree wave '5' are 'small A-B-C / alt. small 1-2-3' up to 4349.25 zone or higher and a small wave '4' pullback expected after that.

See Critical Long-TermUPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report

Thursday, July 1, 2021

Finally Clawing To 'v' Target [Pivot Zone]

This was about as hard a sub-leg that is printing compared to the sprint up since the low zone on 3/23/2020. Weekly breadth is not impressive. Still no top. Another week of lower breadth after this one [if it does not reverse up hard] may create concern for long holders.

See Critical Long-TermUPDATED 4/12/2021 Review Here

The bots will flag here when they see a top. (1/25/20, 2/20/20, 4/9/20)

This Information Is For Entertainment Purposes Only. Financial Loss Can Occur From Investing.

Our favorite go to site- McVerry Report